Financial Depreciation Schedules

Once the Assets have been created and reviewed, the depreciation schedules can be generated, which causes the Fixed Assets application to create all the depreciation entries for the remaining periods of the asset’s useful life. When the depreciation schedules are generated, the system reads the Book Details defined in the Asset class. It uses these details in combination with field values in both the asset class and the asset record to determine how to calculate depreciation for the asset.

Depreciation calculated at upload may be different from what you expect. It is calculated based on the Periods the asset has been in service (LP), the Depreciation amount per period (DA), the Net book value (NBV), and the remaining depreciation periods (RDP).

Navigate to Fixed Assets > Assets

Find the Asset that has been created with the status “To review” and click on that Asset.

*If the newly created asset has any validation issues, the issue details will appear at the bottom of the screen under Validation Messages. Please resolve any issues before proceeding to the next step.

Click the Generate Depreciation Schedule button towards the top right of the page

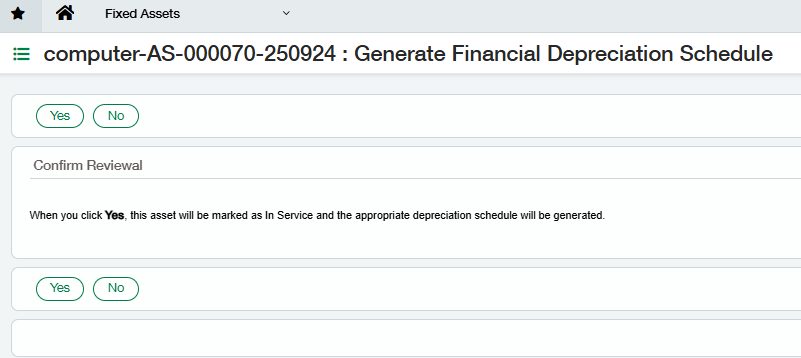

Then click Yes

The system performs the following automatic actions from the above steps:

Financial Depreciation schedules are now created.

The status of the asset has changed to “In Service.”

To see the newly generated schedules, check the Financial Depreciation tab on the asset.

Tax Depreciation Schedules

Before creating Tax Depreciation Schedules, a tax book must be generated first.

To generate a tax book, navigate to Fixed Assets > Assets

Go to the Tax Depreciation tab and click on the checkbox for the Asset Book

On the More Actions drop-down menu, click Generate.

Click on Yes when asked to confirm.

The system performs the following automatic action from the above steps:

Tax Depreciation schedules are now created.