Full disposal of an Asset

Complete disposal of an asset is typically required in one of the following situations:

Sale of an Asset: To receive cash or another asset in exchange for the asset being sold.

Elimination: When the asset is eliminated without receiving any payment in return, or when the asset is no longer in use and has no resale value.

Follow these steps for assets with positive and negative amounts.

Navigate to Fixed Assets > Assets

Open the asset record to be disposed of and click on the Dispose button in the top right corner of the page.

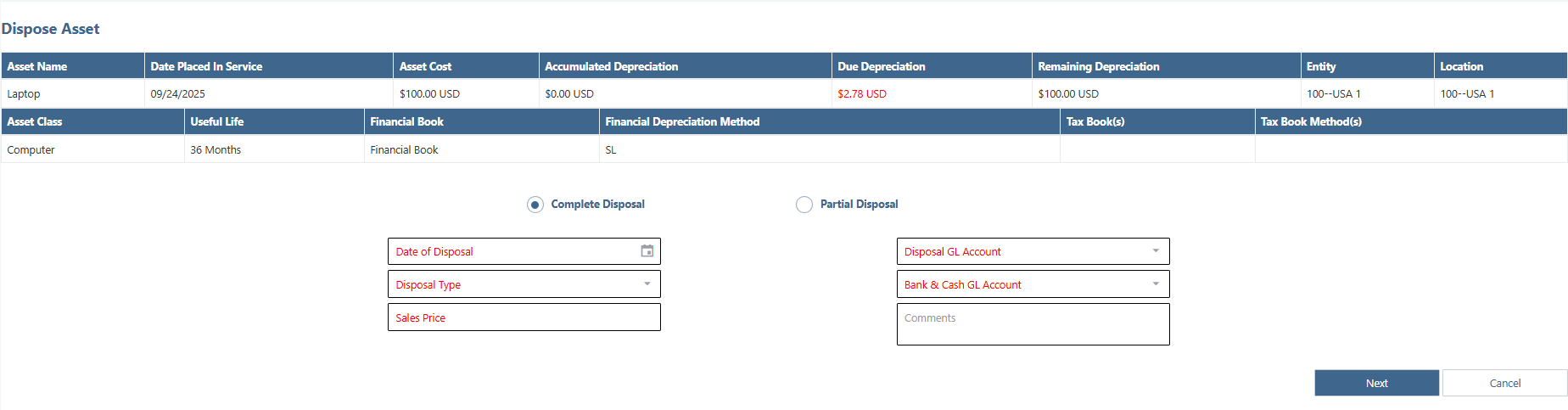

Select Complete Disposal. The fields marked with * are required fields

a. Date of Disposal*: Enter the date on which to completely dispose of the Asset.

b. Disposal Type*: Select the type based on the reason for partial disposal. This value does not have any impact on the calculations and is informational only.

c. Sales Price*: Define the selling price of the partial Asset. If the part of the asset is not sold and partially disposed of due to other reasons, enter $0.00.

d. Disposal GL Account*: Select a Disposal GL Account

e. Bank & Cash GL Account*: Select a Bank & Cash GL Account

f. Comments: Enter comments as desired.

Click on the Next button and confirm the process.

There are several steps to check that the partial disposal process for the chosen asset was done correctly. To do so, navigate to that asset and follow these steps:

On the Asset Tab

a. The Status is “Disposed” and the Status-reason is updated with the reason for the asset disposal.

On the Status Change Tab

a. The disposal cost is N/A, and check that the Sales Price was entered at the time of the disposal.

b. The Date of Disposal is the date when that asset was fully disposed of, and the Disposal GL Batch is linked to the resulting journal entry (structured as shown on the right) created for the partial disposal.

c. Accumulated Depr Partial Disposal: N/A

d. Partial Disposal Source Asset: N/A

e. Partial Disposal Remaining Assets: N/A

f. The Gain/Loss is calculated by the application as Sales Price – (Asset Cost - Accumulated Depreciation) to determine gain/loss on the Asset disposal. Positive amounts indicate a gain while negatives indicate a loss.

On the Financial Depreciation Tab

a. The remaining financial depreciation schedules will have the status changed from “Created” to “Cancelled.”

b. The schedules in Posted status will remain unaffected.