Asset Classes

Asset classes categorize fixed assets and group them according to their business purpose, characteristics, and legal or tax requirements. Please note that all necessary Fixed Asset GL Accounts have been created before setting up Asset Classes. We recommend using a descriptive naming convention to make your asset classes easier to identify in a list. For example, you could name your asset class Computer equipment_36, which describes the kind of asset the class is for, as well as how long its useful life is. To create a new Asset Class, please follow these steps:

Navigate to Fixed Assets > Asset Classes > New Asset Class

Define all information associated with a Fixed Asset that falls under a specific Asset Class. After the following fields are completed, click on either “Save” or “Save & New.”

Asset Type: Tangible/Intangible.

Asset Class: Automobile/Equipment or Leasehold Improvements.

Asset Code: This is a code of up to eight characters in length that becomes a part of the Asset ID. For example, a code of EQ_36 could be used to allow the user to quickly identify equipment depreciated over 36 periods.

Accumulated Depreciation GL Account: Select the desired Accumulated Depreciation account from the GL Account dropdown list.

Depreciation Expense GL Account: Select the desired Depreciation Expense account from the GL Account dropdown list.

Asset GL Account: Select the desired Fixed Asset cost account from the GL Account dropdown list.

Financial Book: Select the book configured to give the desired Financial Depreciation for the asset(s) to be associated with this Class.

Tax Books: Select the book configured to give the desired Tax Depreciation for the asset(s) to be associated with this Class.

Default Disposal GL Account: P&L GL Account (Gain/Loss on Disposal).

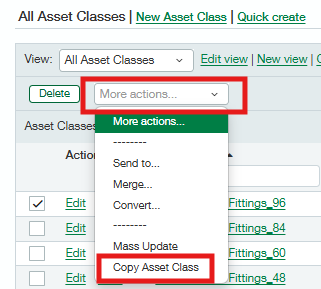

If you wish to copy an existing asset class, navigate to Fixed Assets > Asset Classes

Select the Class to be copied

Navigate to “More Actions” and select Copy Asset Class from the drop-down menu, and the system will redirect to a new page.

Provide a Name and Asset Code for the new Asset Class

Click Copy Asset Classes.

Caution: The same GL Accounts, Fiscal Periods, and Financial Books will be copied over from the original Asset Class to the copied Asset Class.

Tax Books will not be copied over because the same tax book cannot be assigned to more than one Asset Class.

No Assets will be copied over to the new Asset Class.