CIP

The TSG Fixed Assets module provides the ability to accumulate and record the cost of capital work in progress, i.e., construction or development work that is not yet completed. This approach is typically applied to capital budget items. A CIP Item is created from an AP Bill or Fixed Asset record and is associated with a CIP Asset. Upon completion of work in progress, the CIP Asset is capitalized and depreciated. A CIP Item is not depreciated until the CIP Asset is placed in service. As construction in progress costs are accumulated, the related CIP account is debited with the corresponding credit to accounts payable, accrued expenses, or other GL Accounts. When the construction in progress is completed, the related long-term asset account is debited, and the CIP account is credited.

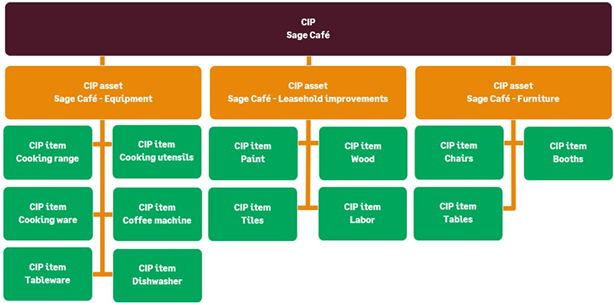

The CIP feature consists of three tables enabling the management of purchases and internal costs (“CIP Item”), as well as the assignment of costs to capital assets (“CIP Asset”) within the scope of a project (“CIP”). The CIP is a hierarchy, where CIP is at the top (the total Project), and CIP Asset is the bucket to collect like CIP items, for example, all the equipment that will be capitalized into the Equipment Asset Class.

A CIP and CIP Asset must be created before the use of CIP automation. A CIP Item can be automatically created from an AP Bill or may be converted from a Fixed Asset record. Regardless of how the CIP item is created, the primary source of a CIP Item is the AP Bill. A CIP Item can also be imported or created manually. Importing of CIP Items is often used to add internal cost records to a CIP Asset.

Once a CIP Item is created, it can be split into multiple CIP Items if needed and can be expensed. During a project, some CIP Items may be tagged as an expense. Before the CIP Asset is capitalized, the user may “Write to Expense” all tagged CIP Items. This can be done during the project or at project completion.

FA V7.0 and later will have the direct post method (new CIP solution) enabled by default. No further actions are necessary to configure CIP. Verify the following pre-requisites to allow creation of CIP, CIP Items, and CIP Assets.

Prerequisites before you start using the CIP functionality:

The Fixed Asset Setting, “CIP – Automation,” is enabled. To check, navigate to Fixed Assets > Fixed Assets Settings and ensure the value is set to True.

The Fixed Asset Setting, “Validation – AP Bill: Manual Override of ‘Is Asset’ and ‘Is CIP’ enablement” is enabled. To check, navigate to Fixed Assets > Fixed Assets Settings and ensure the value is set to True.

*Please note that the validation rules are recommended to be enabled to avoid issues