Optional Set Up

Tax Solution

This setup is required if the need arises to include tax (reclaimable VAT amount) in the asset acquisition cost for assets and CIP Item amount (only if using CIP integration) created from AP Bill and credit card transactions. The default behavior of the application is to exclude the tax amount in the asset cost and CIP item amount generated from AP Bills.

Native VAT solution is enabled

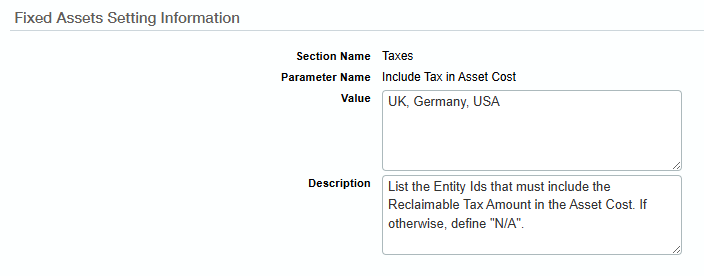

Navigate to Fixed Assets > Fixed Assets Settings > edit the “Taxes – Include Tax in Asset Cost” setting

List the entity IDs in the “Value” field, separated by a comma, that must include the reclaimable tax amount in the asset cost. For example: UK, Germany, USA

Click Save.