Setting up Current and Non-Current Liability Split

Some reporting stakeholders may require you to show your Lease Liability on the Balance Sheet, split between the Current, or Short Term, and Non-Current, or Long Term, components. The Current component is the part of the Lease Liability that will be paid off in the next year, while the Non-Current component of the Lease Liability is the remaining balance that will be owed in exactly one year.

If you wish to split the Current and Non-Current liability in your environment:

Go to Lease Accounting > Lease Configuration.

Scroll to the “Lease & RoU Asset Depreciation Schedule Transactions” section.

Next, select the box next to “Account for Current and Non-Current Liability Transactions.”

In the drop-down menu, select the Default Lease Liability Current Portion Account that your current portion will be posted to.

Save configuration in the top right part of the screen.

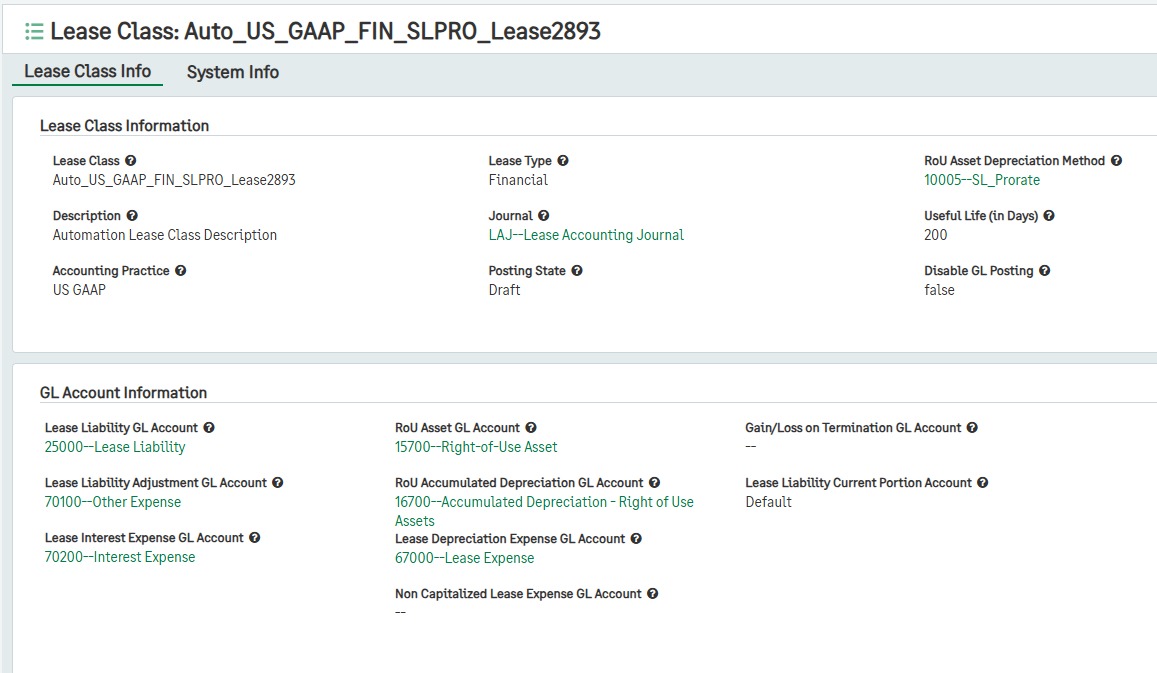

Next, go to Lease Accounting > Lease Class > select or create the Lease Class you are interested in splitting.

After filling out your other fields as normal, select the Lease Liability Current Portion Account.

Note: This account will override the account selected in the Configuration page. If no GL Account is selected in this field, the account listed in the Configuration will be utilized.