Terminating a Lease

There may be instances where a lease is no longer required and needs to be terminated early. Leases can be terminated when they are in the Out of Service workflow status and the Change Status is either Null or “Created.”

Note: A GL Account for Gain/Loss on Termination is required and needs to be defined in the Lease Class before termination. If a Gain/Loss Account is not assigned to the Lease Class, the system will send out an error message, and the lease cannot be terminated.

To terminate a lease:

Navigate to the lease that should be terminated.

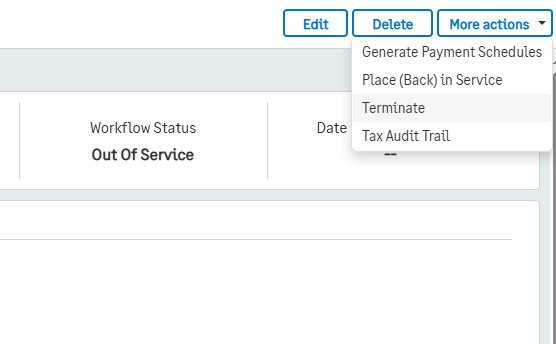

Select More Actions in the top right corner.

Select Terminate.

A Termination Date and a GL Posting Date will need to be provided for a termination entry to be created. This entry will record the remaining balances on your lease.

By default, both these fields are the date on which Terminate Lease was selected. The termination date must be after the start date of the lease, and the GL Posting Date must be in an open period.

When a lease is terminated, the Lease Accounting module will perform a set of updates to the lease as well as create a set of entries.

Below is an explanation of the potential updates and entries that can be made when terminating a lease:

For Payment Schedule Entries:

Any payments due after the lease termination date will be marked as Cancelled/Terminated.

If the lease is not set to automatically record payments, the solution will move on to the Lease Liability and RoU asset Schedules. If the Lease is set to automatically record payments, the Lease accounting module will do the following:

Ignore payments made before the last posting date.

For payments scheduled between the last posting date and the lease end date, the solution will create bills using the payment dates and the provided accounting dates.

If the lease ends before the last posting date and there are posted payments, the solution will create new entries for each payment after the end date, reversing the amounts.

The solution will create reversal bills for the reversed amounts and utilize the payment dates and accounting dates.

For Lease Liability and RoU Asset Schedules:

If a schedule entry is after the termination date, the solution will mark it as Cancelled/Terminated.

If the Lease is not set to automatically create these entries, Lease accounting will move on to the GL Batch creation. If Lease Accounting is set up to automatically create GL entries, the solution will do the following:

Ignore entries before the last posting date.

For entries between the last posting date and the lease termination date, journal entries will be created as normal.

If the lease ends before the last posting date and there are posted entries:

The solution will create reversal entries for revaluation, interest, and depreciation, reversing the amounts.

Lease Termination GL Batch Creation:

When a lease is terminated, the Lease Accounting module will generate a GL Batch that will cancel out the remaining Lease Liability and RoU Accumulated Depreciation balances, the original RoU Asset Value, and record any gain or loss at termination.

The Lease Accounting module will create the entries as follows:

Create a new batch with the description "Lease Terminated -" followed by the lease number.

Create four entries:

Debit the Lease Liability account if there's a positive closing balance or credit if the closing balance is negative. If the balance is zero, this entry will be omitted.

Credit the RoU Asset account for the original opening balance.

Debit or credit the RoU Asset Acc Depreciation account based on the difference between the RoU Asset Opening balance and the RoU Asset closing balances on the termination date. This entry will be omitted if the difference is zero.

Create a gain/loss entry to balance the batch. This entry will be omitted if the balance is zero.