Placing Leases Back in Service

Once a lease has been taken out of service, it will need to be Put Back Into Service for it to begin generating AP and GL Entries again.

To put a lease back in service:

Navigate to the Out of Service Lease.

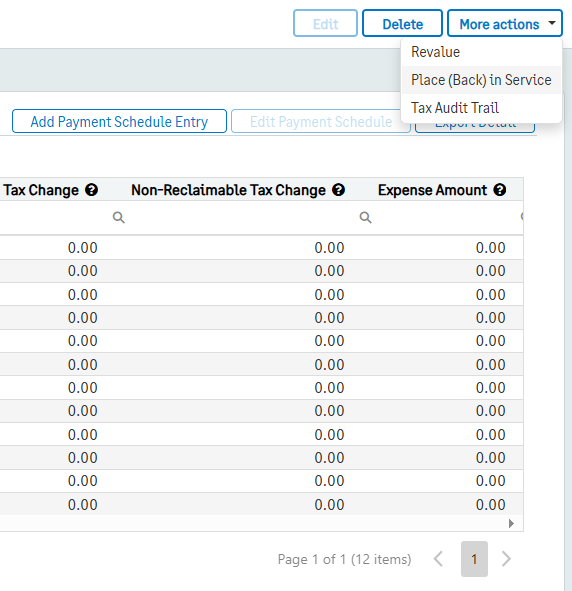

From within the lease, scroll to More Actions in the top right corner.

Select the option to Place (Back) In Service.

Note: If the Change Effective Date is before the last posting dates of the Payment (AP) or Periodic (GL), the system will ask if it should “Catch-up Unposted Transactions.”

Enter a GL Posting Date for any GL entries that should be posted.

It is important to be aware that every change made to a lease will have different outcomes. Below are the different change scenarios and the expected behavior from Lease Accounting when putting the lease back into service:

No changes were made to the Lease Info: There were no changes made that require the Lease Accounting module to generate any additional entries. As some time may have passed since the lease was taken out of service, the option to Catch-up Unposted Transactions will be made available. If the system should catch-up unposted transactions, then Lease Accounting will create the catchup transactions and put the lease in Workflow Status In Service. If not, the Lease Accounting module will not create any transactions and change the Workflow Status to In Service.

The Lease Class, Lease Group, and/or Lease Vendor were changed: Due to these changes, the system will need to create a GL Batch Entry that moves the balances of the Lease Liability, Right-of-Use Asset and Right-of-Use Accumulated depreciation from the GL Account (from the Lease Class) and Dimension (from the Lease Group, and Vendor from the Lease) combinations’ balances from before the change to the GL Accounts and Dimensions after the change. The following entries will be made:

The old Lease Liability Account and Dimensions will be debited, and the new Lease Liability Account and dimensions will be credited, with the Lease Liability Opening Balance on the Change Effective Date.

The old Right-of-Use Asset Account and Dimensions will be credited, and the new Right-of-Use Asset Account and Dimensions will be debited, with the Right-of-Use Asset’s initial value, which is the Opening Balance on day one of the Lease.

The old Right-of-Use Accumulated Depreciation Account and Dimensions will be debited, and the new Right-of-Use Accumulated Depreciation Account and Dimensions will be credited, with the sum of all Created or Posted Depreciation entries for days before the Change Effective Date.

Payment Schedules were changed and Revaluation was performed: When a Lease is revalued, the system will need to create GL Journal entries to adjust the values of the Lease Liability and RoU asset to reflect the revaluation. Assuming the Lease Liability increased, the system will credit the Lease Liability account and debit the RoU Asset account for the value of the revaluation.

Note: If the Lease Liability RoU Adjustment value was also changed, the debit to the RoU Asset Account will be adjusted accordingly, and the balancing entry is posted to the Lease Liability to RoU Adjustment GL Account that is defined in the Lease’s Lease Class.

Payment Schedules were changed but no Revaluation was performed: In this scenario, the change amounts on the Payment Schedule Entries are added to the Expense column on those scheduled entries. Thus, any additional AP Bills created by the Lease Accounting module that have a value in the expense column will result in an additional line to the Non-Capitalized Lease Expense Account defined on the Lease’s Lease Class.

Payment Schedules were not changed, but a Revaluation was performed: If the Estimated Useful Life, Depreciation Method, Lease Type, Accounting Practice, or Lease Liability to RoU Adjustment Amounts are changed and a Revaluation is performed, the RoU Asset schedules may have also changed. If the RoU Asset schedules have changed due to any of the changes mentioned above, the system will need to create GL entries to adjust the Lease Liability and RoU Asset to reflect the revaluation that occurred. If the Lease Liability increases, the Lease Liability Account will be credited and the RoU Asset Account will be debited for the revaluation.

Changes made that Impact the Lease Liability and/or RoU Asset Schedules, but no Revaluation was performed: If any of the following changes were made and no Revaluation was performed, it will be up to the user to decide to either undo the changes or Revalue the lease. The system will not allow leases to be placed back in service for these changes without a revaluation.

The Lease estimated useful life used for the RoU Asset was changed.

The Depreciation Method has changed.

The (Lease Type and Accounting Practice) combination of the old Lease Class and new Lease Class have differing treatments of depreciation.

The old Lease Liability to RoU Adjustment Amount is greater or less than the new RoU Adjustment Amount.

Changes were made that impacted the Payment Schedules, but the Payment Schedules were not regenerated and a Revaluation was not performed: In this scenario, the Start Date, End Date, Total Lease Payment, and/or Payment Frequency were changed, but the Payment Schedules have not yet been regenerated. If the lease is placed back in service, they will be provided with a message informing them that proceeding will undo all changes, and the lease will be put back into service with the previous values.