Generating Liability and Depreciation Schedules

Lease Schedules reflect the liability that is left on the lease while RoU Asset Schedules highlight the Right of Use payments for the lease that payments are being made on. After creating the payment schedules, Lease and RoU Asset Schedules are generated at the same time.

To create Lease and RoU Asset Schedules:

Go to Lease Accounting > Leases, then click the word Leases.

Next, click on the lease that should be put in service.

After clicking into the lease, click the drop-down menu that reads More actions and select “Generate Lease and Depreciation Schedules.

The Workflow Status will be automatically changed to “Generating Schedules In Progress.” Once the schedules have been completely generated, the workflow status will then update to “Schedules Generated.”

Note: Lease and RoU Asset Schedules cannot be generated independently from each other.

Viewing Liability Schedules

Generated Lease Schedules can be accessed by going to the top left of the screen and clicking on the tab that reads “Lease Schedule.”

When clicking on this tab, a table that details the lease will appear. Above the Lease Schedule table, a user can choose to Expand all Groups and Show Canceled/Terminated Records.

Expand All Groups: By default, each record within the Lease Schedule is grouped by its status, and the table is minimized. Clicking this option will maximize all groupings and show all records.

Show Canceled/Terminated Records: By default, the Lease Schedule will hide any Cancelled or Terminated Lease Schedule records. Turning this option on will reveal any records that have been canceled or terminated.

Each column of the Lease Schedule has a search bar under the title so that searching for specific information is easier. There are 13 columns within the Lease Schedule:

Actions: The Actions column shows the Schedule entry after clicking “View” for a specific date.

Schedule Date: The Schedule Date column lists each date between the start and end date of the lease.

Liability Opening Balance: Liability Opening Balance is how much liability is left on the lease at the start of the day. The value is carried over from the previous day’s closing balance.

Payment Amount: The Payment Amount column shows the amount of money paid to a lease on the Payment Date.

Non-Reclaimable Tax: The Non-Reclaimable Tax column of the Lease Liability and ROU Schedules is the portion of the Lease Liability Value and ROU Asset value that is made up of non-recoverable tax. This column reflects the total tax value when the columns are minimized, and the amount of tax included on each scheduled payment when the rows are maximized.

Interest: The Interest column represents how much interest will be added to the liability for that day.

Revaluation Amount: The Revaluation Amount column contains the differences between the original liability and the new liability after a revaluation. For the Lease Schedule, the Revaluation column will be updated with the difference between the New Lease Amount and the Lease Liability Opening Balance on the Change Effective. If there is no change, the value will be 0.00. On the RoU Asset Schedule, the Revaluation column will be updated with the same Revaluation Amount that was applied to the Lease Schedule less any changes to the Lease Liability to RoU Asset Adjustment Amounts. Similarly, if there is no change, the Revaluation value will be 0.00. Once the revalue has been completed, the system will send a confirmation email to say that it has successfully revalued the lease and can now be put back into service.

Liability After Payment: Liability After Payment is how much liability is left on the lease after a payment is made. If no payment has been made for that day, the Liability After Payment will be the same as the Liability Opening Balance.

Liability Closing Balance: The Liability Closing Balance is the Liability After Payment amount in addition to the daily Interest.

Currency: The Currency column shows what currency the transactions are made in for this lease.

GL Batch: The GL Batch contains the Journal Entry number of the journal that was created in the GL for this lease.

Note: If an entry already has a GL Batch, a new entry cannot be reposted.

Status: The Status column reflects the status of the Schedule Entry. There are two states: “Created” which means that the entry is brand new or “Posted” when a GL Batch was created for the entry.

Note: If the status is “Posted,” a GL Batch cannot be reposted.

Schedule Entry: The Schedule Entry number is a system-generated number that uniquely identifies any Lease Schedule entry. Clicking on the number in this column brings up more detailed information such as the Lease, Payment Date, Payment Amount, AP Bill Information, and an Audit Trail.

Created At: This value represents the system date and time when the Lease Schedule was created. It is represented in UTC.

Generating Depreciation Schedules

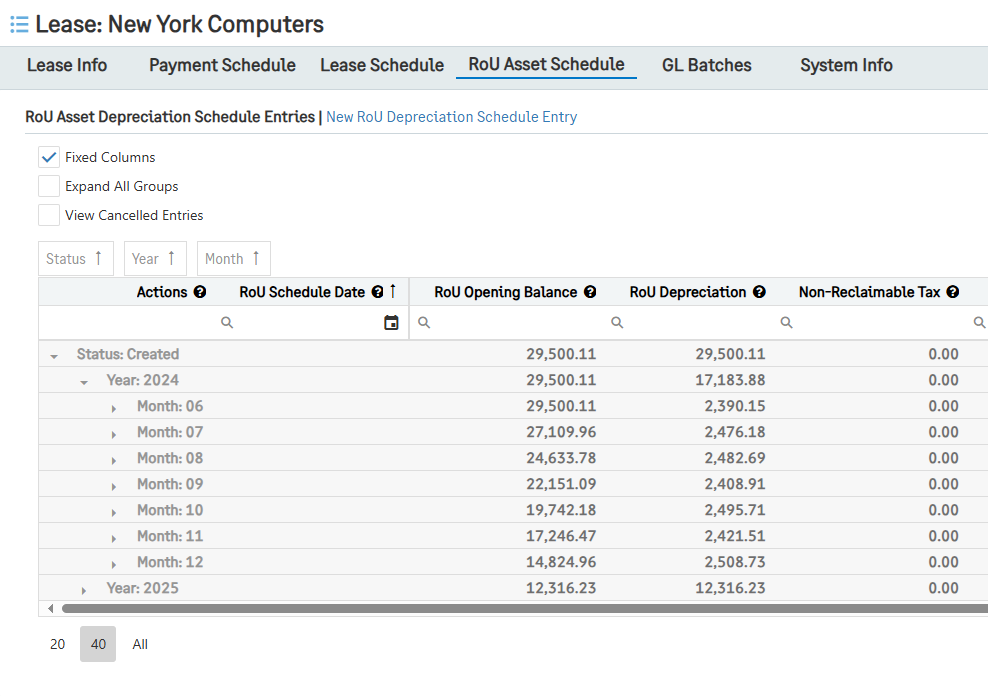

Generated RoU Asset Schedules can be viewed by clicking on the tab titled “RoU Asset Schedule.” After clicking into this tab, a table that details the lease daily will show up. Above the RoU Asset Schedule table, a user can choose to Expand all Group and Show Canceled/Terminated Records.

Expand All Groups: By default, each record within the RoU Asset Schedule Schedule is grouped by its status, and the table is minimized. Clicking this option will maximize all groupings and show all records.

Show Canceled/Terminated Records: By default, the RoU Asset Schedule will hide any Cancelled or Termiated RoU Asset Schedule records. Turning this option on will reveal any records that have been canceled or terminated.

Each column has a search bar under its title where specific information can be searched for if desired. There are 13 columns within the depreciation schedules:

Actions: The Actions column shows the Schedule entry after clicking “View” for a specific date.

RoU Schedule Date: The RoU Schedule Date column lists each date between the start and end date of the lease.

Schedule Date: The Payment Date column lists each day that payment is expected to be made on the lease.

Payment Amount: The Payment Amount column shows the amount of money paid to a lease on the Payment Date.

RoU Opening Balance: The RoU Opening Balance reflects the amount of money left for the RoU payments. The opening balance mirrors the RoU Closing Balance from the previous day.

RoU Depreciation: The RoU Depreciation value is the amount of depreciation on the lease.

RoU Closing Balance: The RoU Closing Balance is the amount of RoU Assets that remain after the depreciation.

Currency: The Currency column shows what currency the transactions are made in for this lease.

GL Batch: The GL Batch contains the Journal Entry number of the journal that was created in the GL for this lease.

Note: If an entry already has a GL Batch, a new entry cannot be reposted.

Status: The Status column reflects the status of the Schedule Entry. There are two states: “Created” which means that the entry is brand new or “Posted” when a GL Batch was created for the entry.

Note: If the status is “Posted,” a GL Batch cannot be reposted.

Schedule Entry: The Schedule Entry number is a system-generated number that uniquely identifies any Lease Schedule entry. Clicking on the number in this column brings up more detailed information such as the Lease, Payment Date, Payment Amount, and Audit Trail.

Created At: This value represents the system date and time when the RoU Asset Schedule was created.