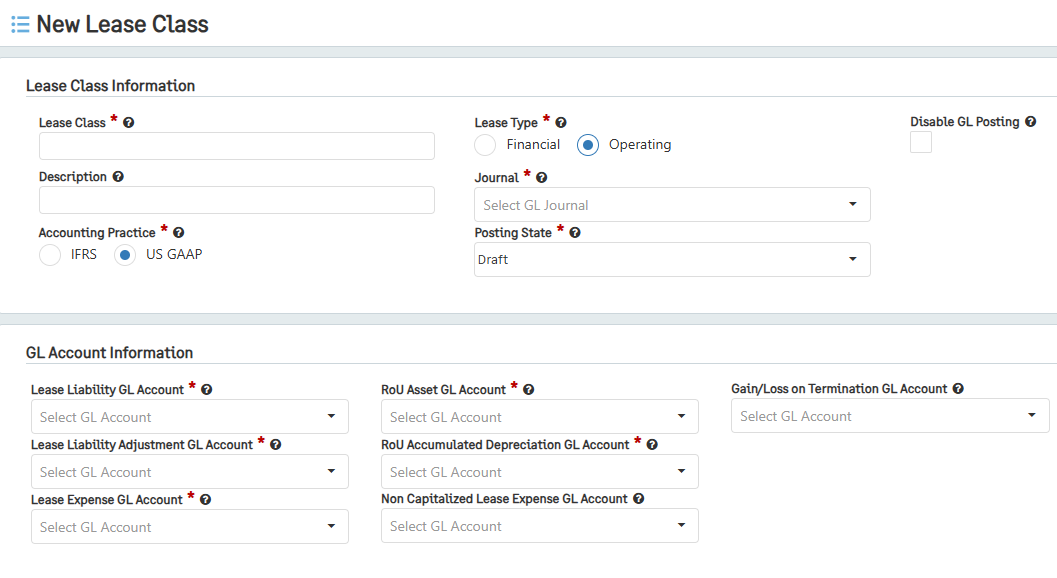

Creating Lease Classes

Next, we will create a lease class so that you can dictate which GL Accounts will be attached to your lease. Please keep in mind that only one class can be attached to a lease at a time, but multiple leases can be attached to the same class.

There are many ways to split up Lease Classes, but it is recommended to so based on different GL accounts used. If you are using the same accounts, then you may only need one class.

Here are the steps to creating a Lease Class:

Go to Lease Accounting > Lease Classes, then click the + icon beside Lease Classes.

Note: Lease Classes can also be created from within a new Lease by going to Lease Accounting > +Lease and then clicking on the + icon within the Lease Class field.

Enter a name for the new lease class in the Lease Class field.

Enter a description of this lease class in the Description field.

Choose a GL Journal for journal entries to be posted to.

Select a Posting State for created transactions.

a. If “Draft” is selected, review the transaction and then post the transaction to the selected Journal.

b. If “Posted” is selected, the transaction is automatically posted and hits the Journal straight away.

Select the Accounting Practice new lease class will define.

There are two types of Accounting Practices: IFRS and US GAAP. Here is more information about the new accounting standards: click here for IFRS leases and click here for US GAAP leases

Select the Lease Type that the new lease class will define.

There are two types of leases: Financial and Operating. The Lease Type drives behavior for Operating or Financial based on the rules of the applicable accounting standards.

Select the RoU Accumulated Depreciation GL Account.

This selection will be used to post the RoU Depreciation each month.

Select the RoU Asset GL Account.

This selection can be used for the balance sheet to recognize the RoU Asset.

Select the Lease Liability GL Account.

This selection can be used for the balance sheet to recognize the Lease Liability.

Select the Lease Liability Adjustment GL Account.

Select the Gain/Loss on Termination GL Account.

This selection is used to recognize any gain or loss when a Lease is terminated before the Lease end date.

Select the Lease Expense GL Account.

This selection can be used for the income statement to post the RoU Depreciation each month.

Select the Lease Liability Current Portion Account.

If the liability should be split between current and non-current portions, the current portion will be posted to this account. This account will also override the selection made in the Lease Configuration page.

Click Save.