Sage Intacct Fixed Assets

Comprehensive solution for managing the Fixed Assets lifecycle

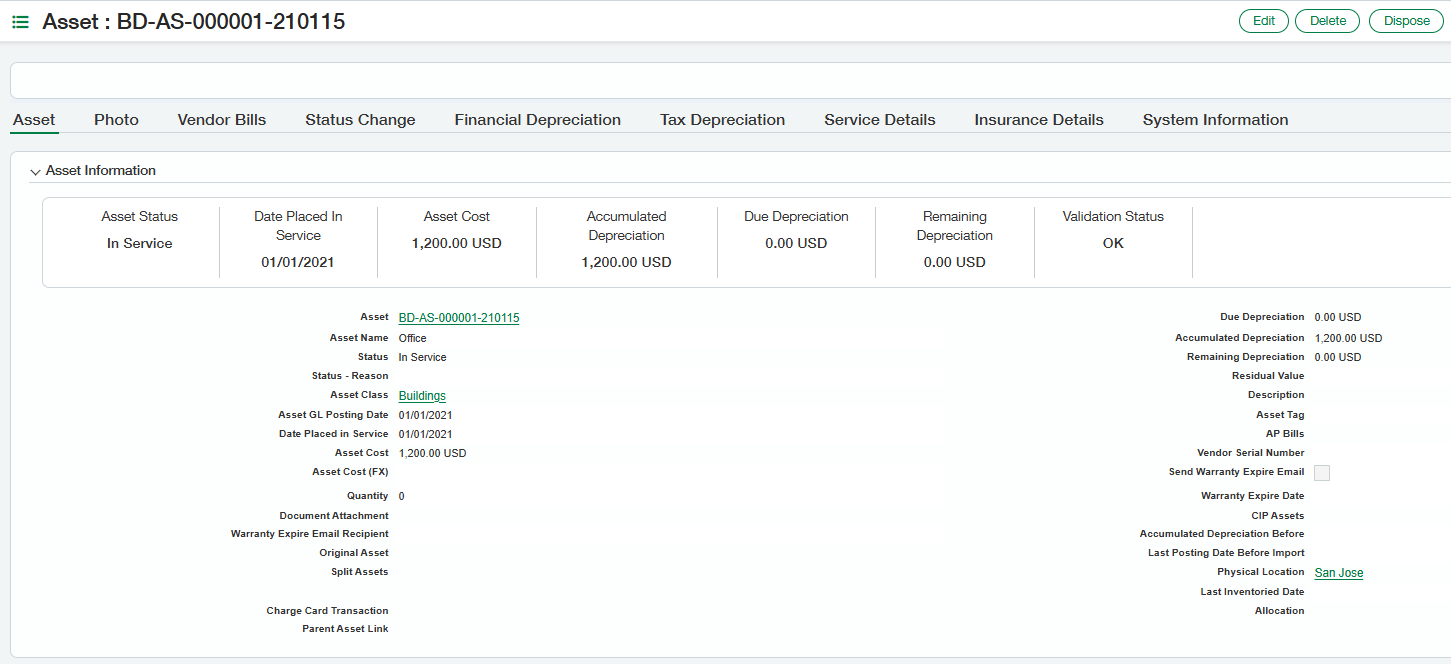

By automating key processes such as acquisition, depreciation, and disposal, it enhances accuracy and efficiency while reducing manual effort. With features like dimensional tagging and cloud backup, you gain unparalleled visibility and security over your assets. Experience streamlined asset management and improved financial insights with Sage Intacct Fixed Assets—empowering you to make informed decisions and safeguard your company's valuable resources.

Fixed Assets Key Benefits

Complete Asset Management

Manage the entire asset lifecycle from acquisition to disposal, ensuring all asset-related data is centralized and easily accessible.

Enhance Accuracy and Efficiency

Automate asset acquisition, depreciation, and disposal processes, reducing manual data entry and minimizing errors.

Improved Financial Visibility

Gain deep, dimensional visibility into asset valuation, condition, and status, enabling better decision-making.

Risk Reduction

Maintain Complete audit trails and secure data which helps in reducing and ensuring compliance

Fixed Assets FAQ’s

-

Up to 50,000. If more assets are required, please contact SIG for more information and details.

-

No, a user can provision Fixed Assets without the help from Support or the Provisioning team.

-

Each instance of Fixed Asset must be individually provisioned. Every time you copy/refresh a company, the provisioning team must be updated for the company’s license and web services user & password.

Even if the application exists in the Intacct company and the smart events are working, the Intacct Instance will be recognized as a new company on the SIG servers and it will not work.

SIG works on different servers than Sage Intacct core due to the additional customizations and integrations that work separately from Sage Intacct core platform.

-

Yes. The following are the different areas where UDD can be enabled for the creation of journal entries because of FA operations.

Posting Financial Depreciation Schedules

FA disposal

Taking the asset out of service

Writing the CIP to Expense

Capitalization of CIP Asset

Transferring an Asset (depending upon the type of the transfer, it is supported in FA V5.0 and FA V5.5)

Ready to start using Sage Intacct Fixed Assets?

The link below will take you to the Fixed Assets Help center, where you will find videos, the setup and user guide, release notes, and more. To learn more about how to gain access to the module, please reach out to your local Sage Intacct Sales Representative.